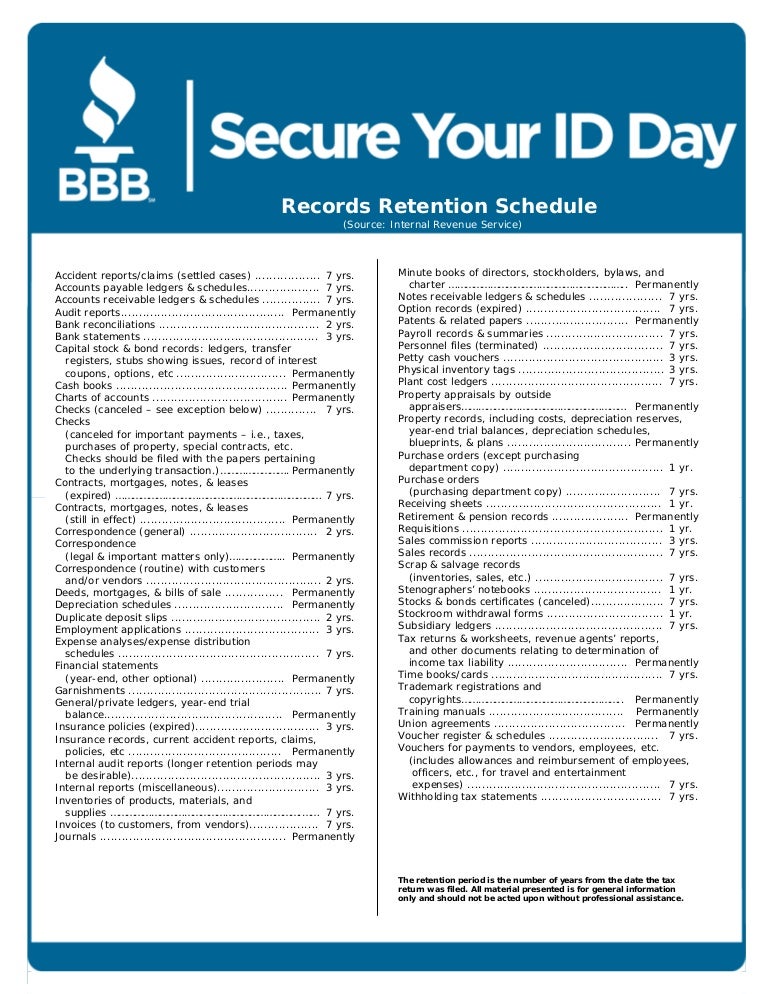

Record Retention Schedule 2025. These schedules provide the minimum retention periods for records created by local governments and have been approved by the state records committee, as required. These retention guidelines should be counted from the later of the tax return due date or the filing date of the return.

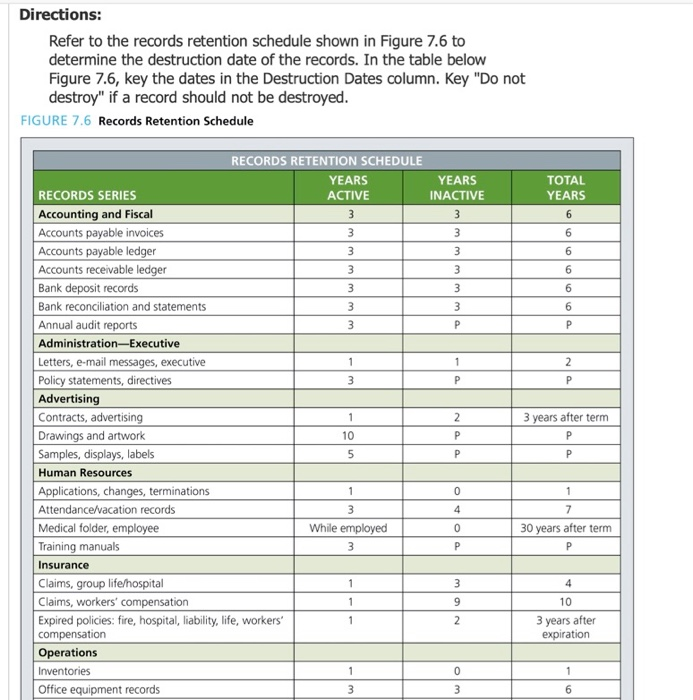

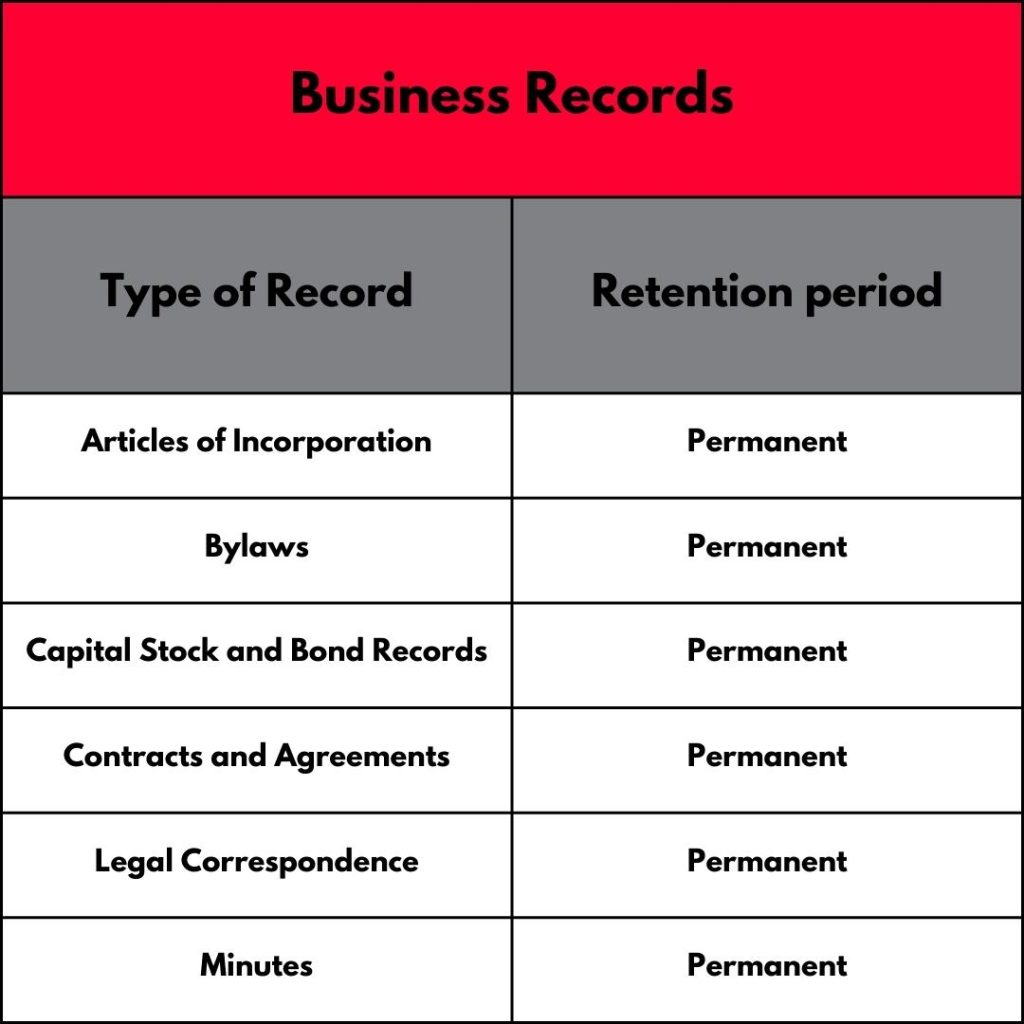

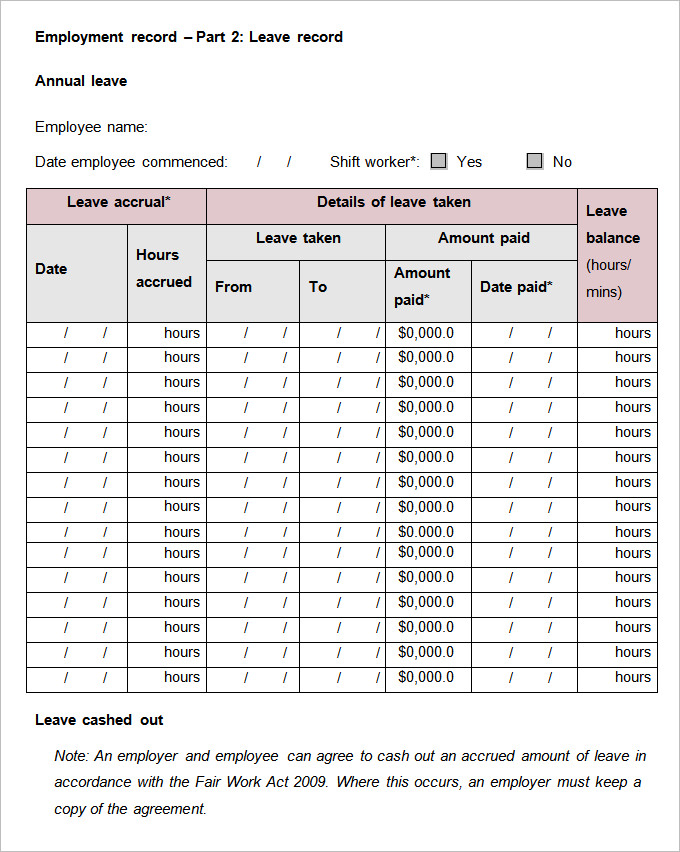

A record retention schedule is a list of records maintained by all or part of an organization together with the period of time that each record or group of records is to be kept. Common record categories include records, such as budget and accounting records,.

Record Retention Schedule Guidelines for Every Office Document, These retention guidelines should be counted from the later of the tax return due date or the filing date of the return. The records classification and retention schedule is divided into eleven major sections by work functions.

Record Retention Schedule Guidelines For Every Office Document Free Report, The most important element in a records retention schedule is to determine how long records are to be held before going to an. The irs has some rules when it comes to how long you and your business should keep records.

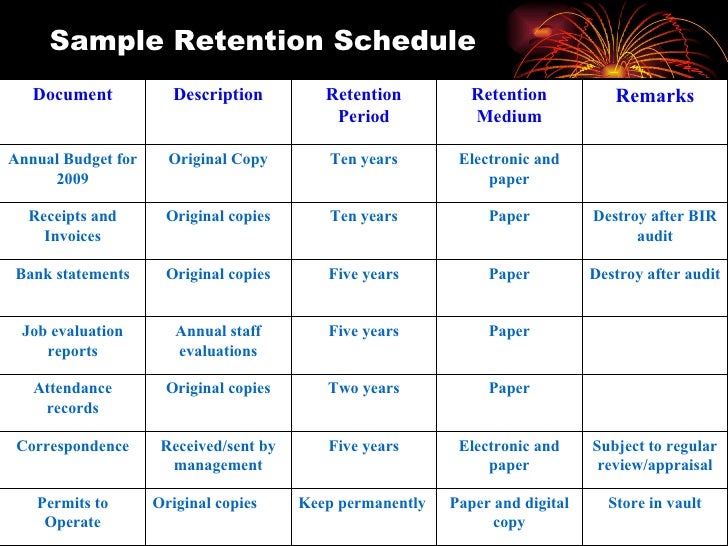

Retention Schedule Template, Retention & disposal schedules identify all of the records that are maintained by government agencies, regardless of format. Our committ ment ensures the highest standards of record keeping for current and future generations of nevadans next:

What Is Records Retention Schedule Template? Free Sample, Example, Records retention schedules list the re cords created, used and maintained by state age ncy personnel, alon g with retention and disposal information for those records. This schedule provides retention periods for common records created by state agencies.

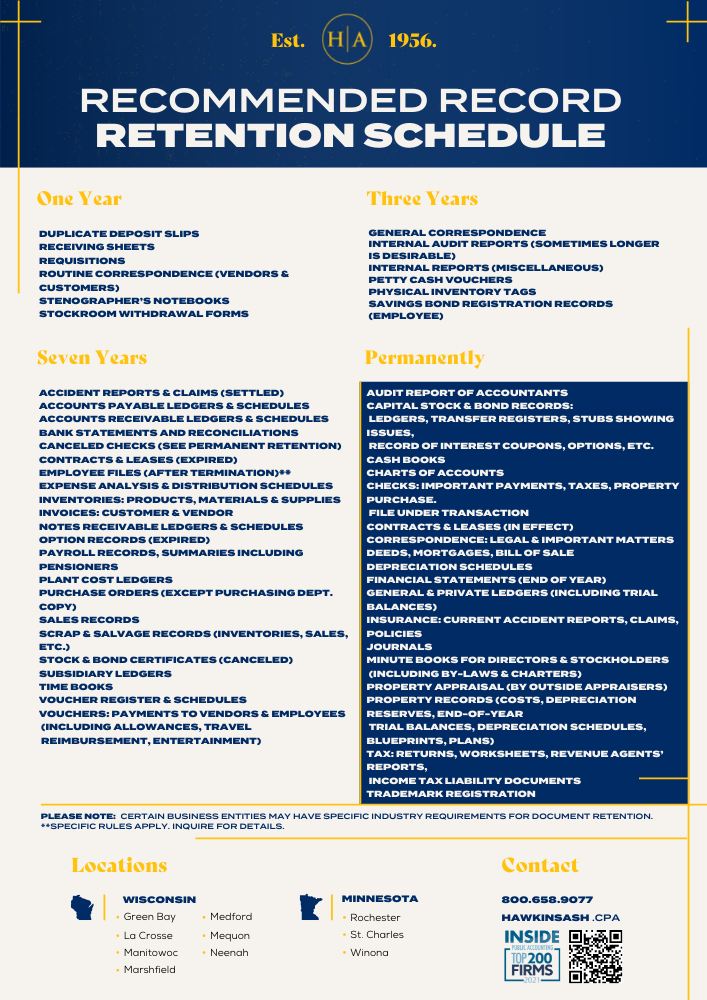

Record Retention Schedule Hawkins Ash CPAs, Common record categories include records, such as budget and accounting records,. This schedule provides retention periods for common records created by state agencies.

Records Retention Schedule Template Best Template Ideas, The irs has some rules when it comes to how long you and your business should keep records. Common record categories include records, such as budget and accounting records,.

Business Record Retention Times & Schedules Shred Nations, How to develop a records retention schedule. The justification for the retention periods, legal or operational, should be.

Records Retention Schedule, A record retention schedule is a list of records maintained by all or part of an organization together with the period of time that each record or group of records is to be kept. Good personal record keeping can cut your taxes and make your financial life easier.

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF Formats, A records retention and disposition schedule is a list of records series titles that indicates the minimum length of time to maintain each series. A record retention schedule is a list of records maintained by all or part of an organization together with the period of time that each record or group of records is to be kept.

How Long To Retain Your Records Shred Nations, In this webinar, we will discuss how organizations can create modern and more compliant records retention. Schedules should avoid declaring that email should be retained, for two years, for example, as email may contain many record types with varying retention periods.